The Transparency Movement; A Heart to Heart with Mohammad Rezvanifar, the CEO of SSIC

The Transparency Movement; A Heart to Heart with Mohammad Rezvanifar, the CEO of SSIC

SSIC is one of the biggest economic holding companies in the country, belongs to Social Security Organization and is managed by Mohammad Rezvanifar, entered the stock market from the beginning of the current year.

SSIC from business to shareholding

Mohammad Rezvanifar succeeded Morteza Lotfi as the CEO of SSIC in 1397. He is a B.A. and M.A. graduate of Imam Sadegh University in theoretical economics, and has received his PhD degree from Allameh Tabatabaee University in business management in the subfield of organizational behavior and human resources. With 15 years membership experience in university faculty and teaching in Imam Sadegh and Tehran Universities, Mohammad Rezvanifar is one of the most successful managers in the country that has outstanding administrative records in addition to possessing theoretical knowledge. Leading and supervision of more than 40 M.A. theses and PhD dissertations, presenting several specialized /scientific articles and publishing 3 books in management fields, scientific secretaryship of international and national conventions, especially on marketing and sales management, and serious argumentations in some conferences on distribution industry are among his other scientific activities. Now the CEO of SSIC explains more about his 2-year residence in management, and also discusses more about SSIC’s plans for a more colorful presence in the stock market. In addition, Rezvanifar points out other measures implemented during the germination of transparency in SSIC.

Those who avoid entering the stock market and are afraid must be held responsible.

Offering of SSIC’s stocks in the stock market has obsessed many people, whether or not the entrance of SSIC into the stock market will benefit its real owners, i.e. the insured and workers of Social Security Organization. The insured and workers of this organization expressed their disapproval on SSIC entering the stock exchange, and they even say that SSIC’s entrance into the stock exchange means looting their assets. The point to be questioned is that SSIC’s assets do not belong to the government, so what warranty is there that the profits from selling stocks in the stock exchange will return to their real owners, i.e. the insured. I think it is not I but those who avoid entering the stock market and are afraid must be held responsible. Stock market is an international and successful experience in economic transparency and generation and performance enhancement. Anyway, when we decided to join this successful experience, after executing the pertinent legal formalities and gaining the approval of the respected admission board of the stock exchange organization and a set of managerial, financial and transparency actions, the stocks of SSIC were initially offered in the stock exchange on April 15, 2020. The revenue of about 13,000 billion tomans from SSIC’s offerings is not related to government resources and accounts, but this sum totally and literally belonged to Social Security Organization as the main owner and shareholder and has been spent according to the plans and for the good of this organization.

Regarding the importance of the initial offering of this stock, suffice it to say that SSIC with its many hidden angles was a non-cash asset belonging to Social Security Organization that has been converted to an asset with high liquidity and transparency, a measure which is a public demand to improve transparency, public participation, and the managers’ responsibility. The best way to preserve transparency, to promote competitiveness, to enhance performance, and to safeguard and intergenerational asset against spur-of-the-moment decisions is certainly to initiate it into the stock exchange.

SSIC could have been political managers’ backyard before entering the stock exchange.

Could entrance into the stock exchange basically promote transparency in SSIC, or has this been achieved? Critics do not believe in it and claim that transparency cannot be the outcome of businesses’ entrance into the stock market; yet, what is your management team’s approach to this issue, regarding the fact that SSIC has been political managers’ backyard?

First, I have to raise an objection to your last sentence. SSIC could have been political managers’ backyard before entering the stock exchange. If you really know corporate governance and the strict rules of the stock market well, you realize that after entering the stock exchange making spur-of-the-moment decisions is almost impossible. Other advantages worth mentioning regarding the entrance of SSIC into the stock exchange include such things as enhancement of transparency and the timely disclosure of financial information and reports, increase in financing methods and the possibility to decrease financing costs, facility in merger and acquisition processes, obtaining reputation and credibility, suitable evaluation of company credit risk and increase in appropriate financing opportunities, elevation of public trust level and the use of public participation in corporate development and the existence of supervision frameworks in the companies present in the stock market, facilitation of financing for the company’s shareholders through collateralizing SSIC’s stocks, increase in the possibility of the membership of the shareholders in SSIC’s board of directors, the possibility of comparing SSIC’s financial and functional status with other holding companies and firms present in the stock market, and increase in the liquidity of SSIC’s assets and stocks. The very challenge that SSIC’s performance has gained the capability of comparison with rivals and similar companies alone was enough to extract a company from the dark.

SSIC has about 150 projects worth 37,000 billion tomans on the pipeline to be implemented.

Regardless of the arguments posed so far, what do you think will be the positive outcome of SSIC’s entrance into the stock market?

I presume the answer to this question can be approached from both micro and macro perspectives. From the micro perspective, the entrance of SSIC has brought about transparency, and regarding the addition of a good many of the shareholders to the list of this company owners and the annually-held general meetings of the shareholders, conflicts of taste in making such decisions as sale of assets and unconventional transactions with affiliates will be prevented. From the macro perspective, the initial offering of SSIC brought about profoundness of the capital market and absorption of the market activists’ liquidity to a profitable and long-term investment.

What is specifically the growth of SSIC like in the stock market and how do you predict the future?

The net profit of Social Security Investment Company (SSIC) increased from 4500 billion tomans in the fiscal year ending in June 21, 2019 to 19,000 billion tomans in the fiscal year ending in June 20, 2020, i.e. a growth of 327%. With the presence of SSIC in the stock market, the obsession of safeguarding the real shareholders of this company was added to the set of managerial duties, and through various plans and operational measures such as increasing production amount, decreasing costs, revising purchase and sale processes, introducing new products, completing developmental projects, reviving unprofitable companies and making them profitable and increasing the companies’ capital, efforts have been made to create added value for the shareholders as a result of which we predict that SSIC’s net profit will amount to 32,000 billion tomans in the fiscal year ending in June 21, 2021 which is a growth of 70%, which is a prime example of the fulfillment of a significant leap in production and profitability in SSIC.

Currently SSIC has about 150 projects worth 37,000 billion tomans on the pipeline to be implemented. Regarding the growth in performance and fast-paced improvement in profitability process, and also the issue of reevaluation of the assets being on the table, the valuableness glitters more and, naturally, remaining in this investment in the long run is advisable.

Tell us about the latest status of SSIC’s companies entering the stock market. Do you have any other plans for initiating more new companies into the stock market till the end of the year? What is your plan till the end of the 12th government to initiate SSIC’s companies into the stock market?

SSIC has moved from business to shareholding in this period, and through the initial offerings of its holding companies and subsidiaries such as Saba Tamin Investment Co., Tamin Cement Investment Co., Amin Investment Co., Mallard Milk, Caspian Wood and Khazar, and Tabas Activated Coal, SSIC has taken steps to this end. Regarding the initial offerings in the year 1399, SSIC has won 35% in terms of numbers and 50% in terms of value of all the initial offerings. Also, more than 15 companies have been in the queue and process of initial offerings, including North Hamoon Investment Co., Tamin General Industries Investment Co., Baft Chemistry Petrochemicals, Fine Paper Products, Saba Tamin Brokerage, Abyek Cement, Iran Antibiotics Producer, Rightel Telecommunications Services, Rubber Industry Investment (Saba Tire Cord Wire), Ofogh-e Tamin-e Energy-e Toos[1], Exir Pharmaceutical Distribution, Sabir, and Persian Gulf Star Petroleum Refinery that are in the process of admission and offering in the capital market.

We believe that the capital market mechanism and the stock market context are the best way of ownership assignment of companies and of exiting from business. A glance at other ownership assignment methods in the country and their bitter destiny justify my statement. Smart and stable continuation of this path is the best and clearest way to move from business ownership to shareholding.

You had announced in an interview that in the year 1399 SSIC would experience a significant leap. We are nearing the end of the year, how has this significant leap occurred?

We assess ourselves on the assertions and guidelines of the Supreme Leader, who has repeatedly advised economic sectors over the last year. It would be enough to know that during the year 1399 that began on March 22, by the grace of God, various schemes and operational actions such as increasing the amount of production, developing new products, completing developmental projects, exiting from loss and rendering unprofitable companies profitable, increasing the companies’ capital, and organizing the subsidiaries were carried out, as a result of which the net profit of SSIC grow uniquely from 4,500 billion tomans in the fiscal year ending in June 21, 2019 to 19,000 billion tomans in the fiscal year ending in June 20, 2020, i.e. a growth of 327%, and continuing this trend with 70% growth it will amount to more than 32,000 billion tomans in the fiscal year ending in June 21, 2021. The prime example of the fulfillment of significant leap in production and profitability takes place in SSIC. The above-mentioned figures are not merely numbers and statistics, but the realization of profitability in the same SSIC which you called a political backyard. Needless to say that if SSIC had not entered the stock market and had not worked hard round the clock, could a 32,000 billion tomans profit have realized?

In addition to striving for profitability, organization of and focus on state-of-the-art and diverse products in companies was also put on the pipeline; as a result, increasing the capacity of and restarting such closed and semi-closed factories as Kermanshah Citric Acid, Chooka Talesh, and Pars Electric on the one hand, and unveiling 168 new pharmaceutical products and 40 items of new products in rubber (tire), airbag fabric, various types of car oils etc. on the other, with saving 80 million dollars of foreign currency and exploiting 20 developmental projects with an investment amounting to 2,000 billion tomans were the other effective measures occurred in SSIC.

Some critics say that the fact that you have repeatedly announced that SSIC’s net profit has enjoyed a remarkable growth is not precise and much of it is due to fluctuations in the foreign exchange rate. How much of SSIC’s profitability is due to its performance, and how much of it is due to fluctuations in the foreign exchange rate?

Admittedly, fluctuations in the foreign exchange rate have impacted on the performance of all economic businesses in the last two years. But noting two related points in this area seems necessary: First, if fluctuations in the foreign exchange rate resulted in a higher sales rate of products, hence a rise in companies’ revenues, they have impacted on the finished costs of the products as well and thus have neutralized the effect of growth in revenues. Second, if fluctuations in the foreign exchange rate have resulted in higher revenues for SSIC, this opportunity has also been provided for other economic businesses as well. Analyzing the performance of SSIC in various industrial areas and comparing it with that of its rivals, what is notable is SSIC’s remarkable performance compared with rivals in various industrial fields on equal conditions.

For instance, the growth of SSIC’s net profit in the recent fiscal year has been 327% compared with the same previous period, whereas the growth of the net profit of other rival multidisciplinary holding companies has been much lower in the same period. In specific industrial fields, SSIC shows a better performance compared with rivals, too. As an example, the net profit margin of Sanat Daru[2] in the year 1398 was about 31%, whereas the net profit margin of SSIC Pharmaceutical Group has amounted to 39% in the year 1398. Also, the net profit margin of the cement industry was 16% in the year 1398, whereas the same figure has amounted to 24% for SSIC Cement Group. These figures are stated based on the audited financial statements available in Codal.

In addition, it would not be meritless to note that major manufactured products in SSIC group are subject to penal and governmental pricing: There was no increase other than the legal increase announced, and the leap in SSIC’s profit in the above-mentioned period has been the result of such factors as growth in the amounts of production and sale, controlling the costs and increasing efficiency, changing sales policies such as sales through auctions, offering the products in the commodities exchange, removing traders, creating direct sales channels, and also changing the combinations of the products.

It is worth to note that the performance of SSIC is assessed based on previous procedures, budget, and comparisons with other rivals, on the basis of which the performance of SSIC shows a significant leap.

What were the financial balance and the performance of your subsidiaries like in the year 1399? Can it accordingly be said that the claim that your companies have been unprofitable is untrue?

Kind of yes! Because the number of unprofitable companies has diminished to 6 in the fiscal year 1399 from 40 in the fiscal year 1396, and there is a comprehensive plan the extract these remaining 6 companies from unprofitability till the end of the year 1400, which is a remarkable achievement for such a huge group as SSIC. The greatest exit from losses in SSIC happened in Rightel for the first time over the many years of its activity in that its loss of 500 billion tomans loss in the fiscal year 1397 turned to a profit of 113 billion tomans in the fiscal year 1398. A similar happy event occurred in Farabi Petrochemical Company and after many years of making losses, this company turned to a profitable one in the current year. Such instances have happened many times in last two years. It must be noted that the increasing trend of companies toward profitability in recent years has happened with a remarkable pace and, as it was mentioned, the net profit of the group has increased to about 32,000 billion tomans in the fiscal year ending in June 21, 2021 from 1,200 billion tomans in the fiscal year ending in June 21, 2018.

It has been claimed that the monthly costs of the staff, personnel and managers in SSIC subsidiaries, i.e. their astronomical payroll figures, have been one of the reasons for their unprofitability. To what extent has this claim been true?

To answer this question, four points are worth mentioning: First, all the costs related to salaries and perquisites paid by companies are available in the companies’ audited reports and have been uploaded to Codal system. Second, we are required to comply with Article 90 of the Law on Amending Government Financial Regulations, whose observance is verified by auditors, Inspection Organization of Iran, and Supreme Audit Court of Iran. Third, the trend towards exiting from losses in unprofitable companies and continuity in profitability in SSIC nullifies the claim in the above question. Fourth, by investigating the ratio of personnel costs to sales in SSIC compared with industry, it can be seen that this ratio is decreasingly lower than the average of industry.This ambiguity still bothers the retired and workers that the pyramid shape of hierarchies in your subsidiaries in the stock market obstructs any kind of change in the management system under any conditions, and that stocks buyers have no say in changing the managers.SSIC is a multidisciplinary holding company, having 9 holding subsidiaries in various fields of industry, each of which has its own subsidiaries in one or more related industries and form the value chain of the group. This kind of holding-type structure has not only been inexistence and common in our country, but it is also a common conventional type of structures in the international business environment.In this structure, SSIC as the apex of the pyramid and a multidisciplinary group proceed to optimize the portfolio of industry. At the second level of the pyramid, specialized holding companies take steps to optimize corporate portfolio, and at the third level, subsidiaries optimize the portfolio of their products; thus, the existence of such a structure, in addition to creating a chain value due to the diversification of portfolio, leads to a decrease in unsystematic risk and the creation of synergy and value for the beneficiaries thereof. The realization of this is a real example of parenthood advantage in holding companies.Increasing floatation is a gradual trend that paves the way for the presence of other shareholders in the formation of management boards. This has now occurred in most sections of SSIC subsidiaries. Needless to say that this trend is gradual and its pace alters as a result of market conditions.Another issue that has been in the limelight is the fact that this economic complex has been the backyard of politicians in different governments, and people expelled from agencies are inaugurated either as a member of the board of directors or the CEO of one of SSIC subsidiaries to enjoy special salaries; in fact, payments are not clearly organized and are not based on Civil Service Law, but on domestic approvals, which is why many believe that one of the centers of astronomical payments is SSIC’s subsidiaries. How true is the payment of such astronomical salaries?I think what has obsessed you is not our transparency in appointments in this period of management of SSIC, but I do believe that many of your doubts are due to a lack of transparency that existed in previous terms. Investigating the appointments in previous years indicates that on average the résumé and identity information of 40% of those that have been appointed a member of the board of directors in SSIC’s subsidiaries was not available. In other words, there only exists a given name and last name and a minimum of documents about these people and no documents indicating that they had gone through the process of appointments in SSIC or its subsidiaries did not exist. In some periods this figure amounts to 70%, whereas during the current management period, the résumé and identity information of all people along with all the documents related to the appointments have been documented with the pertinent formalities and are available, and you can simply see a remarkable part of this information on our organizational portal. But do you really have this possibility about other big multidisciplinary holding companies or important government businesses?In addition to this, in the entirety of previous periods the average age of the appointees had been over 50, but this figure has been reduced to 43 years in the current management and youthfulness has been put on the agenda. Also, the average number of those with an M.A./M.S. degree and above increased from 60% in previous years to 75% in the current management, and the number of female members appointed to the board of directors of subsidiaries has doubled in the current management.It is noteworthy to say that in order to develop transparency in appointments, such factors as appointing the board of directors with the aim of observing corporate governance principles, enhancing the qualifications of the appointed managers, keeping records to evaluate effective performance, preventing the exertion of taste in appointments, paying attention to meritocracy in appointments, paying attention to promotion from inside and to youthfulness as one of the principle priorities have been considered. To this end, the list of the board of directors of SSIC, holding companies and investable companies are constantly updated and uploaded to SSIC’s site – www.ssic.ir – and also to the site of the Ministry of Cooperatives Labor and Social Welfare, so that it is available to the public. Moreover, to make the process of appointments in SSIC systematic, a site called the Integrated System of Managers and Appointments have been designed, initiated and exploited, and for the first time in the history of this complex personnel documents including 20 informational documents for each of the members of the boards of directors of the companies have been provided and documented. In addition to this, considerations related to inquiry from competent authorities, inquiry about the authenticity of the degree certificate, observance of the article 241 of the Amendment to the Commercial Code and other related regulations have been observed carefully

.SSIC’s subsidiaries must constantly report to people about the profits and losses of their complexes and their lack of strength, and remove unprofitable companies from competition chain. How much has this issue been heeded?

As it was seen in Codal’s disclosure, this company voluntarily disclosed its prediction of the net profit of its subsidiaries on February 2, 2021. Based on these reports, only the cumulative net profit of SSIC’s stock exchange subsidiaries will amount to 28,340 billion tomans by the end of the fiscal year 1399, which shows an 85% increase compared with the same period of the previous fiscal year. In this regard, the 124% cumulative net profit of Sadr Holding Company (from 970 billion to 2,170 billion tomans), the 28% cumulative net profit of Pharmaceutical Holding Company (from 2,540 billion to 3,255 billion tomans), and the 28% cumulative net profit of Petroleum, Gas, and Petrochemical Holding Company (from 4,691 billion to 14,079 billion tomans) can be mentioned.

Also, at the end of the fiscal year 1396, the number of SSIC’s unprofitable companies was 40; by creating the Organizing Unprofitable Companies Workgroup and planning, and the actions taken to stop these companies from making losses, this number was reduced to 28 at the end of the fiscal year 1397, and to 14 at the end of the fiscal year 1398, and two 6 companies at the end of the fiscal year 1399, and with God’s help, the case of unprofitable companies of SSIC will be completely closed in the year 1400, which is a huge event for this great complex. Of course with all the hard work done about preserving the dignity of the decent labor force, thank God in none of SSIC’s subsidiaries, even in the unprofitable ones, there are no deferred salaries in arrears, and all the employees’ salaries and other legal commitments are paid on time.

So, will the worry that the retired and workers’ assets, which were managed for years by some people who did not have the slightest understanding of economic activities and managing companies be eliminated with the transparency that you say has been put into practice, and it’s not just in words.

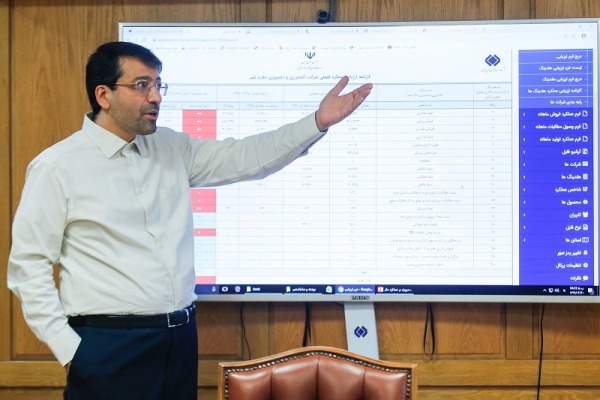

You see, during the SSIC’s current management, transparency has been defined as one of the complex’s main goals, and it’s not regarded only as a motto. In this regard, numerous operational actions have been carried out: disclosing the names and specifications of the board of directors of the subsidiaries on SSIC and the ministry’s websites, disclosing financial statements, reports on capital increase and important information on the Codal site of the Stock Exchange and SSIC’s site (including stock exchange and non-stock exchange companies), promulgating performance information of the subsidiaries to all the beneficiaries, designing and installing management and transparency systems (amounting to 20 systems) are but a few. The results of such actions include obtaining and an acceptable report, compared with the cumulative financial statements and the parent company after 22 years, obtaining an A+ credit ranking and an increase of 30% in acceptable reports in the subsidiaries. A note that is worth paying attention to is that the legal auditor and supervisor of SSIC, its holding companies, and its big subsidiaries, is the Audit Organization, and while on average the percentage of acceptable reports in the Audit Organization is 50%, the percentage of SSIC’s acceptable reports is more than 90% of all, which is an unprecedented record.

One of the repetitive arguments is that Social Security Organization has turned into an organization which the government encroaches, and the residue of the resources of the insured is virtually splashed out by politicians, instead of being used to help Social Security Organization, and the involvement of politicians in investment complexes of Social Security Organization has rendered this complex in efficient. How much of the government’s encroachment is true? Is it true that the resources of retirement funds investments that SSIC is one of them are regarded among the government’s resources?

Let me clarify a point right now. First, SSIC’s resources have no relations with governmental resources and accounts, and all the revenues of this complex, according to the Law of Commerce, belong to major shareholders (Social Security Organization) and minor ones (more than 1,200,000 real and legal shareholders). It must be noted that all the revenues from the initial offerings of SSIC’s stocks belong to Social Security Organization, which have been spent according to this organization’s plans and priorities with the approvals of the Board of Directors and the Board of Trustees of Social Security Organization.

In initial offerings, SSI see alone has monopolized 35% in terms of numbers and 70% in terms of percentages of all the offerings.

But for example, when SSIC paid Marc Wilmots off on behalf of the Football Federation, it faced bitter criticisms from the beginning. Why did you agree to pay wilmuth off and delayed returning the money. After one year of paying cash you received two properties. Is it true that you said you had paid euros, and you would get euros?

It is better for you to know that according to the approval of Supreme National Security Council, and the headquarters for coping with the effects of oppressive sanctions against IRI, in keeping with safeguarding national interests and preserving Iran’s national credit in international arenas and preventing any hostile measures by the country’s sworn enemies, it was decided that 2 million euros from the exports resources of SSIC’s subsidiaries be lent to the Ministry of Sport and Football Federation for six months, which was carried out after the legal procedures and obtaining the necessary approvals from the Board of Trustees of Social Security Organization and the Central Bank. It is worth noting that through a set of follow-ups and legal measures and judicial steps duly done on time, all the SSIC’s credits have been paid off in euros at the rate of the day.

Please explain what your most serious challenge in SSIC is.

The most serious problems and challenges that is SSIC faces include problems in allocating foreign currency, especially in pharmaceutical units, the problems of Article #84 and the impossibility of competition between non-government public institutions and the private sector in absorbing and keeping elite managers and employees, limitation in exports, failure to trim the prices of products in accordance with increasing costs, especially in cement production units, and not allocating foreign currency for reconstruction and purchase of machinery.

How long shall we wait for SSIC to exit from business and enter shareholding?

To exit from business and move toward shareholding, two methods are presupposed: First, utilizing capital market capacity and offering the stocks in it under the conditions of transparency and competition; second, assignment through auction to a limited number of buyers. The second method has created many risks in the trade atmosphere of the country, and due to some shortcomings in pertinent regulations and instructions, it has virtually caused a stoppage in production in the assigned units. In some cases, the contract was annulled, but it seems that using the capital market mechanism and offering the stocks, and then gradually offering them in the capital market is the best strategy. In this term, on the way of moving from business to advanced shareholding, and with the initial offering, SSIC and its holding companies and subsidiaries such as Saba Tmain Holding Company, Tamin Cement Holding Company, Amin Capital Provision Companies, Mallard Milk, Caspian Wood and Khazar, and Tabas activated coal have taken steps in this path. What is important to us is the fact that SSIC alone has monopolized 35% in terms of numbers and 70% in terms of percentages of all the offerings. The good news for the capital market is the placement of over 15 companies in the queue of initial offerings, and a comprehensive plan to assign price earnings ratio stocks in SSIC complex, which will be done as soon as the right conditions are provided. The fast pace of profitability, the development of international markets, the initiation of hundreds of other new products, the establishment of numerous projects in various fields and states, especially in the first half of the year 1400, obtaining several licenses in mineral fields, and increasing SSIC’s capital from 8000 billion tomans to 14,200 billion tomans from capital accumulation fund are in their final stages, and the pertinent license has been obtained from the Stock Exchange Organization. In addition, the issue of increasing the capital from the residual of assets reevaluation in the company and SSIC’s subsidiaries is also on the pipeline.